Click the button to start reading

What is the Purpose of a Trial Balance in the Accounting Cycle?

Have you ever dined at a cafe with mouthwatering dishes and lines out the door, then a week later returned to locked doors and a “For Lease” sign on the window?

It’s a puzzling phenomenon. How could a business with a terrific product possibly fail?

It’s sometimes the way of things that a business presents a united front, but a glimpse behind the scene reveals a tangled mess.

Every business regularly engages in so many transactions, from making sales, to buying equipment and supplies, to paying taxes, employees and rent, that it’s a lot for anyone to keep up with.

And some people aren’t equipped to handle it at all. A frazzled owner who burns the candle at both ends may deliver a fantastic product, but run things amok on the financial end of things. Once a business has an empty cash register and negative balances on its bank statements, it has no choice but to shut the door for good.

But this needn’t be the case. Fortunately, there are tools and systems built to handle this financial complexity. For centuries, double-entry bookkeeping has allowed businesses to identify errors in its books, and continually reap a steady profit, year after year.

A trial balance plays a central part in this time-tested system. It’s a report that allows a company to quickly gauge its financial health, and spot red flags before they become huge problems.

What is a trial balance, exactly, and what purpose does it play in the accounting cycle? In this post, we’ll be covering all that, and more!

Trial Balance: Definition & Purpose

A trial balance (TB) is a summary of the debits and credits of all the ledger accounts within an organization over a given period. In other words, it’s a summation of all of the financial transactions that have occurred during that stage.

It’s a fundamental part of the accounting process, and completing a trial balance is one of the final steps for closing the books at the end of an accounting period.

A trial balance is an internal document, generally. It isn’t shared with investors or outside stakeholders in the way that financial statements are.

Not so very long ago, when accounting was calculated on paper, the trial balance played a central role in keeping tabs on the company’s financials. Now, with the adoption of accounting software into most businesses, the trial balance is not as central, but it’s still a part of the cycle.

“Trial” in this context means “test” or “experiment.” A trial balance is a quick reference point and it’s also a preliminary record for preparing the company’s balance sheet and income statement.

What is the Purpose of a Trial Balance?

A trial balance serves three key purposes:

1) An Internal Check

A central concern for any company is that it might lose track of the money coming in and the money going out. Nobody wants to run out of cash for a few weeks and be pressured to take out a high interest loan just to cover rent and payroll.

A trial balance provides a quick recap or summary of a given period, and provides a clear idea of where the company stands. It’s like having a regular check-up.

It’s good to reference a current trial balance with previous reports, as this helps a company identify transactions or entries that have been overlooked.

2) A Reference Point for Audits

Comparing a trial balance to reports from previous periods can highlight problem areas. Both internal and external auditors use the trial balance to determine which accounts to dig deeper into.

3) A Preparatory Document for Financial Statements

Finally, as previously stated, a trial balance provides account summaries that are critical for putting together a balance sheet and an income statement.

As you can see, a trial balance plays a key role in keeping a company’s books accurate and up-to-date.

Definition of Related Terms

For someone unfamiliar with accounting terms and systems, this explanation of trial balance may not make a whole lot of sense. Before looking at an example of a trial balance, let’s first clarify some key terms.

What is a journal entry?

A journal entry is simply a record of a financial transaction. Any time an organization purchases equipment, makes a sale, or even spends petty cash, the transaction is recorded in a journal entry.

What is double-entry bookkeeping?

Double-entry bookkeeping is an accounting system that dates back to 13th Century Italy. It has been universally adopted into modern accounting. The system uses checks and balances to ensure transactions are all accounted for, and to detect errors right away.

In double-entry bookkeeping, every journal entry affects assets and either liabilities or equity. An entry into one account results in an equal and opposite entry into another.

What is a debit and a credit?

Debits and credits are the two entries utilized in double-entry bookkeeping. These entries record the changes in value resulting from a financial transaction. Every transaction is entered as a debit to one account, and a credit to another. A debit increases the amount in the account, while a credit decreases it.

For example, new equipment is debited to assets, and credited to liabilities. A loan, on the other hand, is debited to liabilities and credited to assets.

What is a general ledger?

A general ledger is a complete record of all the transactions in every account.

Back when accounting was still recorded on paper, an accountant recorded transactions within individual accounts, such as accounts receivable, inventory and accounts payable. A general ledger combines all of these accounts into one. Now, with accounting software, all these transactions are stored within a database.

Sub-ledgers are the individual accounts where transactions are first recorded, before being combined with the general ledger.

What is an audit?

An audit is a thorough inspection to make sure all financial transactions are recorded using the correct process and systems.

Audits can be internal, meaning that a team working for the organization looks through the books to ensure it’s all up to speed. The internal auditor works separately from the accounting department. This is a significant part of the checks and balances system that keeps a company on its toes.

Audits can also be external. In this instance, an outside organization such as the IRS comes into a company and inspects its books to make sure the company is compliant with tax and accounting laws.

Hopefully, this fills in some gaps and highlights some key terms used when discussing a trial balance.

Trial Balance Example

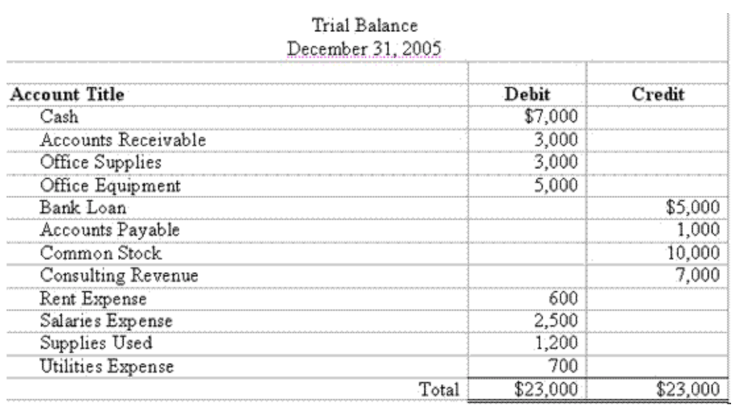

Let’s look over an example of a trial balance, and go over the steps to creating one.

A trial balance always shows the period’s end date.

The left column lists all of the accounts in the balance. Assets are listed first, then liabilities, then equities and finally expenses. This order corresponds with the arrangement of a balance sheet.

In this example, cash, accounts receivable, office supplies and equipment are all assets. Bank loans and accounts payable are liabilities, and the final six accounts are equity and expenses.

The right-hand columns list the transaction amount for each sub-ledger account under either the debit or the credit column.

It can be confusing to remember whether to debit or credit a given account, and so the acronym DEALER is helpful as a reminder.

The first three letters in DEALER stand for Dividend, Expenses and Asset, all of which are recorded on the debit column, while the last three letters stand for Liabilities, (Owners) Equity and Revenue, which are recorded in the credit column.

Note that the total value of debits equals the total value of credits. This must always be the case in a trial balance.

The process for creating a trial balance report goes like this:

- Routinely record all transactions in journal entries, both as credits and as debits.

- When it comes time to create a trial balance, collect all entries from sub-ledger accounts into the general ledger.

- List each account and the corresponding amount into the trial balance template, onto either the debit or the credit side, depending on the account.

- Balance both the debit and the credit sides of the balance. If the two columns are unequal, it indicates that something needs to be fixed.

A trial balance with equal debits and credits is a strong indication of accurate bookkeeping. However, it does not mean that no errors have occurred. Some common errors that wouldn’t be indicated in a trial balance include:

- Values assigned to the wrong account.

- Values incorrectly assigned to debit and credit accounts.

- Double recordings.

As you can see, a trial balance is a fairly simple report to put together. The adaptation of accounting software has made the processes even smoother.

Trial Balance versus Balance Sheet

Due to their similar name, it’s easy to confuse the trial balance with the balance sheet, or to think they’re one and the same. Although each document records similar information, these are separate documents with distinct purposes. Let’s briefly clarify the purposes of each.

A trial balance is an internal accounting report showing a general ledger of all accounts at a single point in time. In a trial balance, the debits and credits equal one another, as each journal entry offsets a corresponding credit or debit. The trial balance is normally only seen by people within the company.

Trial balances may be created frequently, as a quick method to gauge the company’s health.

A trial balance functions as a checkup for an organization, to identify errors in bookkeeping, or as an indication for places to audit. It is also a significant step toward creating a balance sheet.

A balance sheet, on the other hand, lists the assets, liabilities and equities for a single point in time. Although it serves as an important internal document, its central purpose is to communicate a company’s financial health to investors and stakeholders outside the company.

Each of these documents represent a step in the accounting cycle. Let’s look at that next.

The Eight Steps of the Accounting Cycle

The accounting cycle follows a transaction from when it first takes place, all the way until it’s incorporated into the company’s financial statements. Here is a summary of the eight essential steps in this cycle.

1: Identify Transactions

This first step entails collecting records of all of the company’s transactions, including receipts, invoices, paystubs, and bank statements. Scrutinizing each of these transactions determines which account is to be debited and which is to be credited.

2: Prepare Journal Entries

Next, post each transaction into the correct two accounts, using the double-entry system. Each transaction is recorded into the journal entry for the period, with the debit account above the credit account.

3: Post to General Ledger

This step entails taking the entries for each sub-account and posting them into the general ledger, which encompasses all of the accounts.

4: Unadjusted Trial Balance

Prepare a trial balance, listing each affected account for the period. Post the total amount into either the debit or the credit column, depending on if the account is an asset, liability, equity or expense. Total both the credit and the debit columns to see if they are equal.

5: Post Adjusting Entries

Many entries in a trial balance aren’t reflected by a specific transaction that’s taken place during the period. Rather, they’re reflected in depreciation of long-term assets or the amortization of a loan.

Entering these transactions into the unadjusted trial balance means that the balance reflects all transactions that have transpired over the period.

6: Adjusted Trial Balance

Now it’s time to adjust the trial balance and incorporate all of the adjusted entries. At this point, the trial balance is updated and accurate.

7: Create Financial Statements

This is the culminating step in the cycle. Using the trial balance, the company creates first the balance sheet, then the income statement and the statement of cash flows.

The financial statements are significant documents that capture the financial state of a company at a given point in time. They’re helpful for analyzing how a company has grown since the earlier period, and are useful for outside investors to determine if the company makes a prudent investment.

8: Close the Books

The creation of the financial statements mark the end of the given financial cycle. Now a new period begins, and the accounting department returns to the first step of collecting and analyzing transactions.

Every company follows these eight steps. The length of the cycle varies depending on the company. Some companies need to create financial statements quarterly, while others only annually.

Conclusion

As with so many things in life, if you don’t regularly check in on accounting processes, things can quickly fall apart.

A trial balance allows a company to quickly gauge its books and to know whether or not it’s standing on solid ground. It can provide an indication for any internal auditing work to do as well.

Although a double-entry system seems complicated at first, it quickly becomes intuitive and the system provides a company with a solid financial footing.