Click the button to start reading

10 Super Effective Strategies for Managing Cash Flow in your Small Business

Small business owners know being an entrepreneur is a journey of highs and lows. When you’re closing a funding round or launching something your team has spent countless hours on, being an entrepreneur can feel like the best job in the world. But there are other times when you feel the hard parts of entrepreneurship. This is especially true regarding money – and small-business cash flow management can be the make-or-break factor for many small businesses as they navigate challenging times.

Wondering how to improve your small business’ cash flow management? Below, we’re covering what cash flow management is, how to calculate cash flow, and sharing our ten best tips for cash flow management for small businesses.

What is cash flow management?

So – what do we mean by cash flow management? If your cash flow is the money coming in and out of your business, cash flow management is how you manage that money – how you track it, spend it, save it, and invest it.

A cash flow statement shows a company’s ability to operate, both long and short-term, based on the cash flowing in and out of the business. And a cash flow statement typically includes three sections:

- Operating activities

- Investing activities

- Financing activities

The critical difference between your other financial statements – like a balance sheet or income statements – is that your cash flow statement will help you track your cash receipts and payments during a period.

That means it’s possible for a business to be profitable and still have a negative cash flow (or the opposite).

How to calculate cash flow

There are three main formulas used to calculate cash flow. Let’s walk through each cash flow formula below.

Free Cash Flow

Free Cash Flow = Net income + Depreciation/Amortization – Change in Working Capital – Capital Expenditure

Free Cash Flow is the most common cash flow formula. A cash flow statement will offer you a snapshot of your cash at a given time, but it doesn’t necessarily help you plan for the future. Free Cash Flow enables you to understand what money you have available to spend.

Operating Cash Flow

Operating Cash Flow = Operating Income + Depreciation – Taxes + Change in Working Capital

Operating Cash Flow helps you understand your day-to-day cash flow. What we mean by this is that it ignores any irregular cash coming in or out of your business (significant expenses, income, or investments) and instead offers a realistic picture of how much money your business has regularly.

Cash Flow Forecast

Cash Flow Forecast = Beginning Cash + Projected Inflows – Projected Outflows = Ending Cash

As the name suggests, a cash flow forecast is used to anticipate your available cash flow in a future period (month, quarter, year, etc.). This can be helpful to project what money is available to spend if you’re considering a significant investment or trying to anticipate the impact of increased expenses.

10 Tips for Small Business Cash Flow Management

Now that we’ve covered why it’s is so important for small businesses, let’s get into some actionable cash flow management tips for small businesses.

1. Create a Cash Flow Statement

The best cash flow management strategy for a small business owner is to have a comprehensive and reliable understanding of your business’ cash at any period. That’s where your cash flow statement comes in. A cash flow statement is one of the three primary financial statements for small businesses. It considers your operating, investing, and financing activities to understand your cash on hand. Luckily, many accounting softwares can generate these reports for you!

But what is healthy cash flow? A positive cash flow is when a business takes in more than it spends. With positive cash flow, you can pay expenses, make investments, or save money for the future. A negative cash flow, on the other hand, is when the business spends more than it takes in. Companies with negative cash flow may want to evaluate their revenue collection or expenses to ensure they can meet their obligations. A note: while negative cash flow can be problematic for an established company, it isn’t always cause for concern. New businesses with high-startup costs or going through a growth phase commonly have negative cash flow.

2. Forecast income and expenses

With a clear picture of cash flow, business owners can better forecast their future income and expenses. This means more proactive (rather than reactive) decisions on managing your cash on hand and more realistic planning. The Cash Flow Forecast formula can help with this.

For example, let’s say your business needs to invest in a piece of equipment with monthly payments or hire a new employee. While you might have positive cash flow now, forecasting helps you understand how these expenses will impact your cash flow at a point in the future.

What do you do if the forecast isn’t adding up? We’ll get more specific below, but you might consider delaying certain payments where interest is lower, negotiating with suppliers, leasing equipment, or seeking financing if you believe the investment will ultimately result in positive cash flow.

3. Managing expenses or optimize accounts payable

Everyone’s heard the advice about cutting your daily coffee to save money. Of course, no guarantee cutting your latte budget will bring a business positive cash flow, but it does illustrate the most known and most straightforward way to have more cash – cut your expenses.

You might start by evaluating your big expenses when managing your cash flow. Consider which costs can be replaced with a more affordable alternative or canceled altogether. But let’s say you’ve done that and don’t find any significant opportunities to save. Another method to better manage your expenses better is to optimize your accounts payable. That might mean prioritizing invoices based on their due dates, paying off invoices with the highest interest first, or negotiating with vendors for a more flexible payment schedule. Of course, this might mean not always paying invoices as received, so this approach should come with other processes that ensure you don’t miss payment deadlines!

4. Collect receivables promptly

Taking in money is the easy part, right? That’s not always the case!

The other part of cash flow management is the cash coming into your business. If you’re experiencing negative cash flow, an impactful place to start is improving your process for collecting receivables.

This might look like collecting deposits before beginning projects – the amount will vary by industry. You can also consider updating your invoicing cycle (how often you issue invoices and when payments are due) or creating incentives for clients who pay early or penalties for those who pay late.

5. Inventory Management

One of the most significant inefficiencies for small businesses is excess inventory. This might be final products taking up shelf space or raw materials that went above what was required for the project. The cost to your business is not just the materials themselves but often the storage space they occupy.

Effective inventory management means having better tracking in place over your production process. Categorize your inventory based on its value and how quickly it turns over to help determine where to invest limited resources. When in doubt, follow the 80/20 rule, where 80% of profits come from 20% of your stock.

You should also regularly audit your inventory and suppliers to ensure any inefficiencies in the production process are smoothed out. There are softwares that can help with that!

6. Lease equipment or payment plans

Most of us have been taught that owning is better than renting and debt is bad. A big part of being an entrepreneur is unlearning these things! Sometimes they’re the solutions that make the most sense.

As outlined in the cash flow formulas above, having the cash on hand now doesn’t always indicate future cash flows or money available to invest. When it comes to equipment or other significant investments, renting or leasing can be more affordable and a way to ensure you have access to the most updated technology. You also might consider payment plans for larger purchases – even if the total amount owed is greater.

7. Borrow money before you need it

Many business owners turn to loans only at a critical moment. But with better forecasts and planning, you can identify funding needs before the situation becomes dire.

Planning allows you to spend more time finding a loan with favorable terms or flexibility. It also communicates to potential creditors or investors that you’re thinking ahead and planning to avoid future issues. Implementing a robust loan management system can significantly enhance your business’s financial management capabilities, ensuring more efficient handling of loans and repayments.

8. Working with the best

While optimizing your receivables is one way to ensure you have cash on hand, there are often other parties involved that impact when you receive your payments. For example, if you rely on a merchant services provider, you want to consider payout timelines or processing fees. This also trickles into your vendors and suppliers – aim to work with companies that deliver quality, are on-time, and are efficient in invoicing and collection.

Relationships are everything when it comes to this aspect of business. If you get to a point where you need extra time to pay an invoice or updated terms, having a solid relationship with your vendors can ensure more flexibility and less stress in the process.

9. Prevent fraud

Even with a great team or positive cash flow business, protecting yourself against fraud or other vulnerabilities is a smart idea for any small business. This starts with day-to-day things – it might make sense to have a culture with more oversight over personnel expenses (overtime, business expenses, etc.) to ensure that your estimates and forecasts of costs are reliable. If you notice a department or team member whose expenses are deviating, you can be more proactive in understanding why this is happening.

On a higher level, fraud can mean inaccurate reporting or theft. To protect your business (and your cash flow) from fraud, at a minimum, you should carefully limit permissions on financial data and accounts to those who need it. Additionally, even small teams should have at least two people overseeing finances to ensure checks and balances.

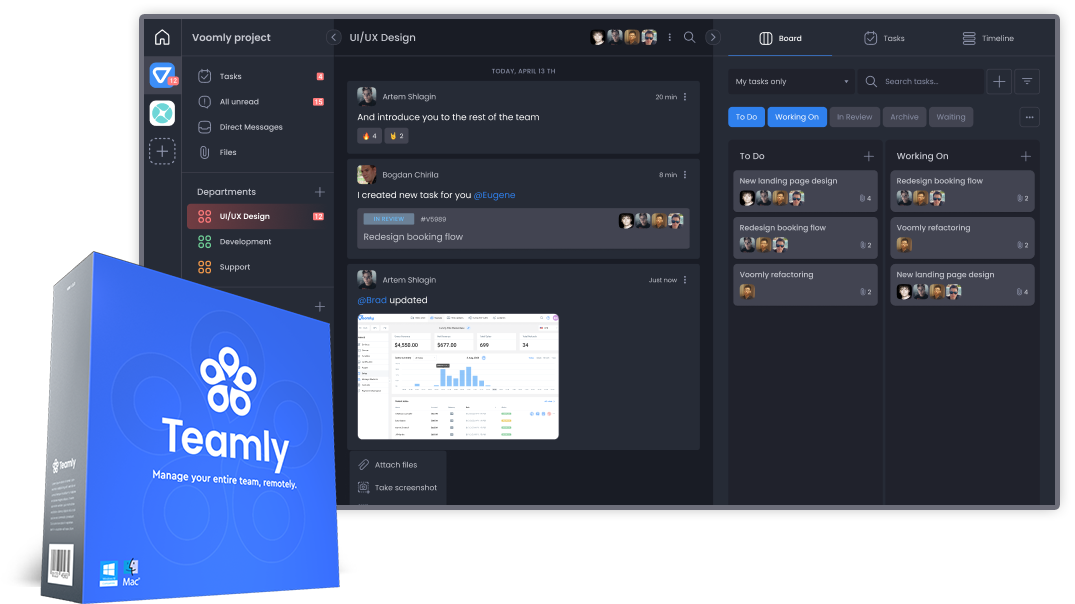

10. Choosing the Right Software

Software has now automated or streamlined what used to be manual processes. Small business owners will find software products for accounting, payroll, time tracking, expenses, etc., that can make complex and time-consuming processes easier.

Automated reporting and detailed record keeping is one reason why working with software is better than the old-fashioned way. But if it ever gets too overwhelming, software doesn’t necessarily replace a financial or accounting professional who can better leverage the software to fit your business needs and interpret the data to inform future decisions.